A black female architect feels she was discriminated against when a banker in Washington state looked up her company and called the human resources department after she deposited her paycheck.

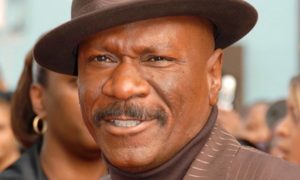

Trish Doolin’s story gained traction when her friend Sugar (who declined to give her last name for safety reasons) took a screenshot of Doolin’s Facebook status describing her experience at a KeyBank branch in Kirkland and tweeted it.

Pls. RT

When you’re 1 of a handful of Black female architects EVER and you try to cash your payroll check @keybank. pic.twitter.com/U1pndNGvFv— bald headed Sug (@whoissugar) October 5, 2016

Doolin, a job captain of architecture at design firm Nelson, Inc., told BuzzFeed News that she had just moved to Seattle a few weeks ago and stopped at KeyBank on Wednesday morning to deposit her paycheck.

Nelson had recently moved to Washington, Doolin said, and employees’ direct deposit service hadn’t taken effect yet.

“I went in, deposited my check, and went about my day,” the 37-year-old Kansas City, Missouri, native said.

A few minutes later, the banker called her, told her there had been a problem with her check, and asked her to return to the bank.

BuzzFeed News called the employee back and reached the voicemail of a man named Thor Loberg, whose LinkedIn profile lists him as a personal banker at KeyBank’s Kirkland branch. A bank teller at the same location confirmed he worked there.

She was taken into a cubicle, and noticed when she sat down that the bank teller — whom she described as white — had already pulled up her design firm’s website on his computer.

“He asked my profession, and then asked why the company’s headquarters were in Philadelphia,” she said. “Then he asked if HR could verify that I was an employee there.”

As he dialed her company, Doolin said he “kept saying it was for the bank’s safety,” adding that at no point did he ask for her ID.

When her company didn’t answer the phone, the man proceeded to tell Doolin that because her account had not been open for 30 days, the bank had to hold her paycheck for nine days to verify the funds.

“When I realized that I was defending who I was, trying to prove to someone I didn’t know who I was, I knew I was being discriminated against,” she said. “It was just completely demeaning.”

Doolin left the bank and went home. Around 4:30 p.m. she called the bank, and a woman answered. She told her what had happened.

“‘I can assure he is far from racist,’” the woman told Doolin. “’He would have done that to any other customer.’”

The woman eventually released Doolin’s funds after realizing that her account had been open for 29 days, one day shy of the requirement.

“She made sure to tell me that she was sorry that I was ‘having a bad day,’” Doolin said. “At the end of the conversation, she told me, ‘Go have a drink or something.’”

But Doolin said that situations like this cannot be chalked up to a bad day, or soothed by a happy hour.

“I live in a world where, no matter what’s in my brain or purse, no matter how I wear my hair, no matter how fabulous I look when I walk out the door, I’m still black,” she said. “People still clutch their purses when I walk past.”

Doolin, who said she is on the path to becoming a licensed architect, said she plans to switch banks this weekend, but hasn’t talked to her job about her experience at KeyBank yet. She is not sure how to.

“When you’re black, you can’t go marching around saying, ‘I’ve been discriminated against.’” she said. “It’s that silent pain. You can still hurt, but just don’t do it too loudly.”

In response, KeyBank said in a statement to BuzzFeed News it typically places a hold on deposited funds during the first 30 days after a customer has opened open a new account:

“As a company, KeyBank values diversity within our organization, our communities and our clients. We do not tolerate discrimination. Client confidentiality means we cannot speak to any specific client’s situation. We can however, describe our Funds Availability Policy regarding client deposits and holds that may be placed on client deposits. Generally speaking and in compliance with applicable law, we advise clients who are new to KeyBank that we may place holds for a short period of time on their deposits during the first 30 days after they open their account with us. ”

Source: Buzz Feed

Written by: Tamerra Griffin

![[Video] Chicago Police Officers Caught On Video Telling Two Black Men "We Kill Mother F**kers"](https://earhustle411.com/wp-content/uploads/2018/07/evil-cop-3-300x180.jpg)

![[Video] Chicago Police Officers Caught On Video Telling Two Black Men "We Kill Mother F**kers"](https://earhustle411.com/wp-content/uploads/2018/07/evil-cop-3-80x80.jpg)

![[Video] White Woman Calls The Cops On Black Real Estate Investor, Cops Threaten To Arrest Her For Harassing Him](https://earhustle411.com/wp-content/uploads/2018/05/nosy-neighbor-300x180.png)

![[Video] White Woman Calls The Cops On Black Real Estate Investor, Cops Threaten To Arrest Her For Harassing Him](https://earhustle411.com/wp-content/uploads/2018/05/nosy-neighbor-80x80.png)

![White Scientist Says The Black Community Is Being Targeted By The Medical System, They Are Deliberatly Being Poisoned [Video]](https://earhustle411.com/wp-content/uploads/2016/05/mike-adams-300x180.jpg)

![White Scientist Says The Black Community Is Being Targeted By The Medical System, They Are Deliberatly Being Poisoned [Video]](https://earhustle411.com/wp-content/uploads/2016/05/mike-adams-80x80.jpg)

![Teenage Girl Shot In Her Stomach Three Times But Took Time To Post To Facebook [ Video]](https://earhustle411.com/wp-content/uploads/2016/02/Gangster-chick-300x180.jpg)

![Teenage Girl Shot In Her Stomach Three Times But Took Time To Post To Facebook [ Video]](https://earhustle411.com/wp-content/uploads/2016/02/Gangster-chick-80x80.jpg)